Drastic changes in the regulatory environment and the government’s decision to set price cap on certain medical devices have taken a heavy toll on the Indian medical technology sector and scared away foreign investors, the latest official statistics show. Drastic changes in the regulatory environment and the government’s decision to set price cap on certain medical devices have taken a heavy toll on the Indian medical technology sector and scared away foreign investors, the latest official statistics show.

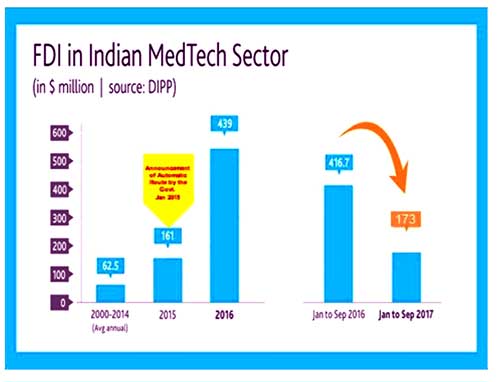

The foreign direct investment (FDI) in the sector nosedived 41.52% to hit $173 million during the January-September 2017 period compared to the corresponding period of the previous year, according to data from the Department of Industrial Policy and Promotion (DIPP).

The sector had attracted $416.7 million in foreign investments in the first nine months of 2016.

The steep decline in foreign investments will have a significant impact on the sector that represents 9 per cent of the overall healthcare industry. The figures also paint a bleak picture as the Federal government is keen on boosting foreign fund flow into the domestic medical devices market which is the fourth largest in Asia and on the list of top 20 in the world. Currently, India has about 750–800 medical device manufacturers with an average investment of Rs.170–200 million and an average turnover of Rs.450–500 million.

Despite the severe dent in foreign fund inflow, industry representatives remain upbeat about future prospects in the wake of government’s decision to tweak the FDI policy. The policy had stated that definition of medical device would be subject to amendment to the Drugs and Cosmetics Act. As the definition in the policy is complete in itself, the government has decided to drop the reference to Drugs and Cosmetics Act from it and amend the definition of medical devices.

“The decision is a welcome step. One of the important determinants of quality in the medical technology sector is FDI and technology transfers which go hand in hand with it. This government had the foresight to bring FDI in the medical devices on the automatic route. The steady surge in FDI, since the decision to bring it on the automatic route, is demonstrative of the potential of this sector. But this year the rising curve of FDI has witnessed a severe dent,” Director General of Medical Technology Association of India (MTal) Pavan Choudary told Pharmabiz.

Many industry representatives emphasised the need for a stable regulatory environment to spur growth and woo potential investors. “Unnuanced market interventions or the atmosphere of regulatory unpredictability and haste often drive away strategic investors. MTaI companies have made remarkable investments in manufacturing and R&D in India and are the main propellers of FDI. Hope through this liberalising measure, India can reobtain the gradient acquired,” he added.

In a statement, Association of Indian Medical Device Industry (AIMED) Forum Coordinator Rajiv Nath termed the decision to amend the definition of medical devices in FDI policy as “just housekeeping and tidying up”.

"Department of Pharmaceuticals (DoP) should learn from DiPP and ministry of health and delink ‘devices’ from ‘pharmaceutical’ after treating devices as sub sector of pharmaceutical (drugs). Both are medical healthcare products but different and need different policies to boost investment. We have always welcomed 100 per cent greenfield investment in India for medical devices but are opposed to 100 per cent auto route without oversight of DoP for brownfield takeover of the few indigenous medical device manufacturers who have been providing an alternate affordable access to cost effective desi brands," Nath opined.

|