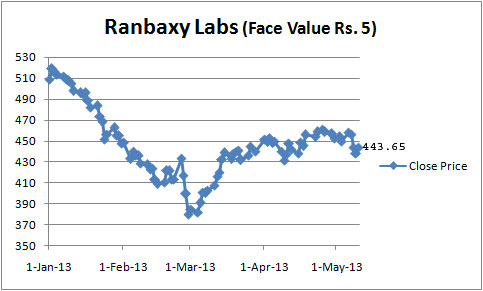

Ranbaxy Laboratories, a leading Indian pharmaceutical company now controlled by Daiichi Sankyo Co. of Japan with shareholding of 63.52 per cent, has failed to generate any investors confidence owing to poor financial show in the first quarter ended March 2013. Though the BSE Sensex and BSE Healthcare (BSEHC) index improved significantly, Ranbaxy scrip declined continuously during last several trading session on Bombay Stock Exchange and currently moving in the range of Rs.440-450. Ranbaxy scrip touched to its 52-weeks peak level at Rs.578.30 on September 4, 2012 but touched to lowest level at Rs.370.50 on March 1, 2013. Ranbaxy Laboratories, a leading Indian pharmaceutical company now controlled by Daiichi Sankyo Co. of Japan with shareholding of 63.52 per cent, has failed to generate any investors confidence owing to poor financial show in the first quarter ended March 2013. Though the BSE Sensex and BSE Healthcare (BSEHC) index improved significantly, Ranbaxy scrip declined continuously during last several trading session on Bombay Stock Exchange and currently moving in the range of Rs.440-450. Ranbaxy scrip touched to its 52-weeks peak level at Rs.578.30 on September 4, 2012 but touched to lowest level at Rs.370.50 on March 1, 2013.

Ranbaxy scrip was closed at Rs.518.70 on the opening day of 2013 and BSE HC of 17 pharma companies at 8166 points. However, the scrip received continuous selling pressure on account of legal hassles regarding quality problems in US, limited outcome from R&D investments, interest burden, competition and non-payment of dividend for last couple of years. As against the upward movements in BSEHC to 8,882 points, a growth of 8.8 per cent, with satisfactory financial performance from Ranbaxy's competitors, the scrip declined by over 13 per cent during first four and half months of 2013. The same downtrend in Ranbaxy is likely to exhibit in the next few months and analysts are waiting for settlement outcome in respect of quality problems as well as new product launches. Meanwhile, the BSE Sensex of 30 scrips improved by 2.1 per cent to 19,990.18 points during the same period.

Currently the foreign financial institutions and domestic institutions are holding 10.55 per cent and 10.04 per cent respectively of total 42.30 crore equity shares of face value of Rs.5 each. Non-institutional holding is at 13.8 per cent, bodies corporates at 3.04 per cent and others 12.85 per cent as at the end of March 2013. At the current market price the market capitalization worked out to Rs.18,568 crore on BSE.

Ranbaxy scrip dwindled down as it could not launch new product in US or other markets as well as absence of contribution from exclusivities like in the corresponding quarter of last year. Its consolidated net sales declined sharply by 34.2 per cent during the first quarter ended March 2013 to Rs.2,440 crore from Rs.3,709 crore and net profit by 90 per cent to Rs.125 crore from Rs.1,247 crore. EBDITA also lower by 76 per cent to Rs.253 crore from Rs.1,057 crore. Its sales in US and West Europe declined significantly, though its sales in India, East Europe & CIS and emerging markets improved. The sales in North America declined to Rs.689 crore from Rs.2,093 crore in the same quarter of last year as it included sales of two exclusivity viz., atorvastatin and amlodipine plus atorvastatin. Its sales in US amounted to Rs.596 crore.

The standalone net sales also declined 26.6 per cent to Rs.1,328 crore during the first quarter ended March 2013 from Rs.1,810 crore in the same quarter of last year. Its net profit went down sharply to Rs.70 crore from Rs.827 crore. Its R&D expenditure remained stagnant at Rs.102 crore in the first quarter and it filed three ANDAs with US FDA. It launched desvenlafaxine, an NDA for Pristiq and gained market share in Absorica, isotretenoin NDA, under a licensing agreement with Cipher Pharmaceuticals, Inc. The exclusivity period for pioglitazone hydrochloride authorised generic came to an end in mid February 2013.

Ranbaxy has turned the corner during the year ended December 2012 on account of exclusivity for two products in US markets, resumption of supply of atorvastatin tablets to US after some quality issues, commenced supply to US after four years from Indian facility and launch of Synriam for the treatment of malaria in India. It generated net profit of Rs.923 crore as against a net loss of Rs.2,900 crore in the previous year. The loss for the year 2011 was mainly due to settlement provision of Rs.2,648 crore and loss on foreign currency option of Rs.1,124 crore. The company provided Rs.186 crore for the product recall as compared to nil in the last year. It reduced the foreign exchange loss to Rs.41 crore from Rs.1,124 crore. Its consolidated net sales went up sharply to Rs.12,166 crore during 2012 from Rs.9,967 crore in the previous year. However, the company failed to declared any equity dividend for both the years.

The company is setting up greenfield manufacturing project in Nigeria and upgraded its facility in South Africa to cater the increasing demand from that region. It is also setting up an oral solid dosage forms facility in Egypt and commenced the operation at its new manufacturing facility at Morocco. Further, Ranbaxy is investing in a green field manufacturing facility as an Entry Point Project in Malaysia. The company is implementing Hybrid Business Model with Daiichi Sankyo to tap markets like Romania, Germany, Venezuela and Thailand. Ranbaxy is set to file product in Japan through its new joint team.

Ranbaxy's R&D expenditure declined by one per cent to Rs.449 crore from Rs.453 crore, which worked out to 7.4 per cent of net sales as compared to 6.1 per cent in the previous year, which is very small as compared to R&D spending by several international pharma giants. Out of the total R&D expenditure for the year 2012, staff cost amounted to Rs.171 crore (almost 38 per cent of total R&D expenditure), raw material cost worked out to Rs.128 crore (28.5 per cent), clinical trials & analytical charges amounted to Rs.37 crore (8.2 per cent), repairs Rs.23 crore (5.2 per cent), rent Rs.13 crore (three per cent) and other expenditure including legal, traveling, communication, recruitment, printing & stationery reached at Rs.77 crore ( 17.2 per cent). Thus the major R&D expenditure is marked for staff cost, raw material, repairs, rent, traveling and other heads.

During the last five year i.e. from the year 2008 to 2012, Ranbaxy's aggregate R&D expenditure amounted to Rs.2,365 crore and this worked out to 8.3 per cent of aggregate net sales during the same period. The company received final ANDAs approval for 17 ANDAs from US FDA during this period of five years and three tentative approval. Thus, this shows that the R&D spending of leading company in India is not offering expected returns in the form of profits.

As against the equity capital of Rs.211 crore, its reserves and surplus on consolidated basis amounted to Rs.3,872 crore as compared to Rs.2,658 core. The company's total borrowings went up by 20.2 per cent to Rs.4,846 crore from Rs.4,033 crore. Its fixed assets, including capital-work-in progress, increased marginally by three per cent to Rs.5,201 crore from Rs.5,049 crore. Inventories touched to Rs.2,731 crore as against Rs.2,611 crore. The company owns manufacturing facilities in seven countries viz., India, US, Ireland, Malaysia, Nigeria, Romania and South Africa. Its total number of subsidiaries reached at 49, of which eight subsidiaries are based in India.

The short term outlook for the Ranbaxy looks bleak and the quality problem with US FDA may hamper the future growth. It has already identified and implemented multiple corrective and preventative actions. It also commenced the supply of atorvastatin tablets to US. Further, the company has also provided Rs.2,648 crore for any likely settlement provision in the previous year. The product launches in highly regulated markets, strong support of Daiichi Sankyo and focus on emerging market will be crucial factors to overcome stiff competition and adverse marketing conditions. The investors may have to wait for another year for better returns from the market or in the form of dividend.

Ranbaxy: Financial Highlights

|