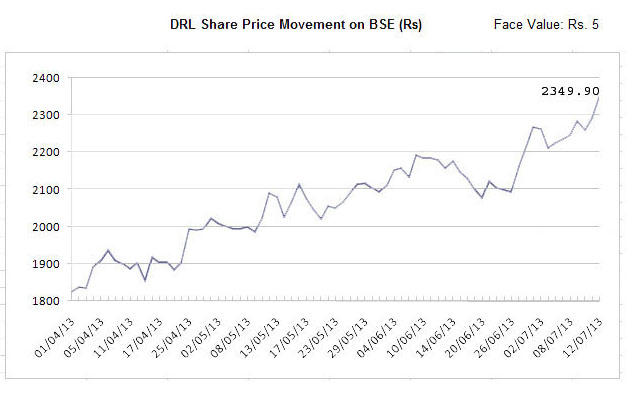

Dr Reddy's Laboratories (DRL), the second largest pharmaceutical company in India after Ranbaxy Laboratories in terms of sales, has consolidated its position in the international market during 2012-13 and likely to clinch the No 1 spot in the Indian pharmaceutical segment in the current year with investment in Research and Development (R&D) and focus on highly regulated as well as emerging markets. DRL scrip touched to its yearly peak level at Rs.2,349.90 on Bombay Stock Exchange on July 12, 2013 with market capitalization of over Rs.39,450 crore, a second largest in the Indian pharmaceutical market after Sun Pharmaceutical Industries in terms of market capitalization. Dr Reddy's Laboratories (DRL), the second largest pharmaceutical company in India after Ranbaxy Laboratories in terms of sales, has consolidated its position in the international market during 2012-13 and likely to clinch the No 1 spot in the Indian pharmaceutical segment in the current year with investment in Research and Development (R&D) and focus on highly regulated as well as emerging markets. DRL scrip touched to its yearly peak level at Rs.2,349.90 on Bombay Stock Exchange on July 12, 2013 with market capitalization of over Rs.39,450 crore, a second largest in the Indian pharmaceutical market after Sun Pharmaceutical Industries in terms of market capitalization.

DRL scrip of Rs.5 each moved up smartly by over 26 per cent during last three months and currently hovering over Rs.2,300 on the BSE as against Rs.1,825 as at the start of April 2013. In last July it touched to its yearly low level at Rs.1,592. The scrip outperformed BSE Healthcare index as well as BSE Sensex in last three and half months. The BSE Healthcare (BSEHC) index of 17 companies improved by almost 15 per cent to 9,332 points from 8,085 points during this period and BSE Sensex of 30 companies by five per cent to 19,849 points from 18,865 points. The strong financial performance in 2012-13, acquisition of OctoPlus NV, Netherlands, and dividend of 300 per cent boosted the investors sentiment.

To tap enhanced opportunities in the international market, DRL is focusing on R&D activities and quality standards during the last couple of years. The investment in R&D activities increased significantly by 29.8 per cent to Rs.767 crore during the year ended March 2013 from Rs.591 crore in the previous year on consolidated basis. This worked out to 6.6 per cent of its consolidated revenues. The company management is now planning to step up its R&D investment in the range of seven to eight per cent in coming years to build larger pipeline of complex generics, new formulations and biosimilar.

With the help of R&D investments, the company was able to launch 104 new generic products globally and filed 56 new product registration and 47 new drug master files. The cumulative number of DMF filings reached at 577. Its R&D centres are also located at Cambridge, Netherlands and USA. Further, the company has created R&D partnerships with several companies, including its subsidiary Aurigene and Dr Reddy's Institute of Life Sciences.

The company is now focusing and investing more in biosimilars products which will offer innovative medicines to patients across the globe at an affordable cost. DRL has already pushed four biosimilars viz, rituximab, filgrastim, darbepoetin alpha and peg-filgrastim in the market. To consolidate its position in biosimilars, DRL entered into an alliance with Merck Serono, a division of Merck KGaA, Germany during June 2012 to co-develop and globally commercialize portfolio of biosimilar compounds in oncology primarily focused on monoclonal antibodies (Mabs).

During the year ended March 2013, DRL achieved strong financial performance with significant growth in international market despite difficult economic conditions and competition. Its consolidated net sales increased to Rs.11,627 crore from Rs.9,674 crore in the previous year. Its global generic sales moved up by 18 per cent to Rs.8,256 crore from Rs.7,024 crore and contributed to 71 per cent to its total net sales. The sales of Pharmaceutical Services and Active Ingredients (PSAI) improved by 29 per cent to Rs.3,070 crore from Rs.2,381 crore and that of proprietary products increased by 12 per cent to Rs.300 crore from Rs.268 crore.

DRL's aggregate sales of generics and PSAI in North America increased by 20.6 per cent to Rs.4,359 crore from Rs.3,616 crore in the previous year. Out of this, generic sales amounted to Rs.3,785 crore as against Rs.3,189 crore. The sales improvement is mainly due to higher sales from antibiotics portfolio and products from Shreveport formulation plant. It launched 14 new products and filed 18 ANDAs during 2012-13 in North America.

Similarly, its sales of generics and PSAI in Europe improved by 18.3 per cent to Rs.1,973 crore. But, its generic sales in Europe declined by seven per cent to Rs.772 crore from Rs.826 crore. Its generic and PSAI sales in domestic market improved by 16.2 per cent to Rs.1,920 crore from Rs.1,652 crore and that in Russia & CIS and ROW improved by 24.5 per cent to Rs.3,075 crore from Rs.2,469 crore.

The consolidated net profit has taken a quantum jump of 18 per cent to Rs.1,678 from Rs.1,426 crore in the previous year. The growth in profit is restricted on account of one-time profit share revenues from sales of olanzapine 20 mg tablets in the US in the previous year 2011-12, unfavourable impact of price erosion in the US and Germany and significant rise in power and fuel costs in India. Its earnings per share improved significantly by 17 per cent to Rs.98.44 from Rs.83.81. The company management recommended handsome equity dividend of 300 per cent for the year 2012-13 The book-value worked out to Rs.429 as compared to Rs.338 in the previous year.

As against the equity capital of Rs.84.9 crore, its reserves and surplus amounted to Rs.6,284 crore during the end of March 2013 from Rs.4,904 crore in the previous year. Its long term borrowings declined to Rs.1,266 crore from Rs.1,642 crore. However, its short-term borrowing increased to Rs.1,899 crore from Rs.1,589 crore. Its gross fixed assets, including capital work-in-progress improved by 12 per cent to Rs.4,616 crore from Rs.4,120 crore. DRL has invested close to Rs.3,600 crore in the last five years to increase capacity in existing infrastructure and create new capacities in oral solids, injectable facilities and biosimilars.

To overcome the stiff competition in generic segment, DRL has decided to focus on difficult to make molecules which require specialized and unique technology platforms. To achieve necessary results it acquired 98.9 per cent stake in OctoPlus NV, a service/ specialty pharmaceutical company during February 2013. OctoPlus has significant in-house expertise in development and creation of micro-spheres and liposomes using certain polymer based technologies.

Thus, the focus on discovery and development of new molecules, global R&D partnerships, expiration of patent exclusivity and strong financial indicators will offer necessary boost to DRL scrip in current year. Further, the rupee depreciation against US Dollar may push its exports income from highly regulated markets. Its standalone exports on FOB basis increased sharply to Rs.6,100 crore during 2012-13 from Rs.4,841 crore in the previous year, a strong growth of 26 per cent.

DRL : Financial Highlights

|