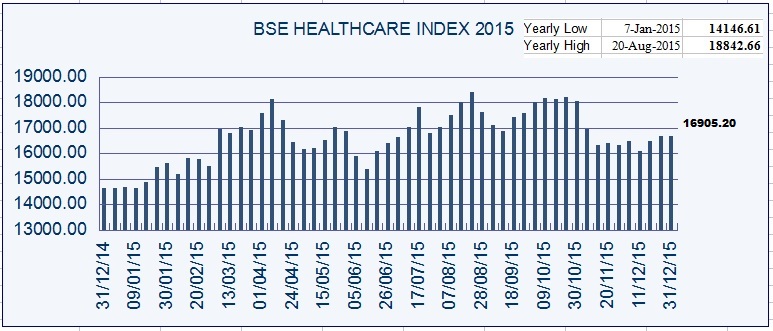

The overall performance of pharmaceutical & healthcare segment remained positive despite several odds and the S&P BSE Healthcare index of 63 leading pharma and healthcare companies improved by 15.1 per cent in 2015. Index movements remained volatile during the year 2015 and closed at 16,905.20 points on the last trading day of 2015. The Healthcare index outperformed BSE Sensex during 2015 as Sensex declined by 5 per cent over the year. The revised healthcare index touched to its highest level on August 20, 2015 at 18,842.66 and same was nosedived to lowest level at 15,345.66 points on June 12, 2015.

Effective April 16, 2015, Asia Index Private Ltd (AIPL) has replaced old index with new S&P BSE Healthcare. The closing value as of April 15, 2015 for index was used as base index value for the new index. Out of total 63 scrips included in BSE Healthcare index, 23 companies are from 'A' Group.

Similarly, NIFTY Pharma index of ten leading companies closed at 11,963.50 points on December 31, 2015 as against 10,949.80 points on December 31, 2014. It reached yearly high at 14,020.70 points as against yearly lowest at 10,525.65 points. The index covered ten leading companies like Dr Reddy's Laboratories, Piramal Enterprises, Glaxo Pharmaceuticals, Cadila Helathcare, Sun Pharmaceutical, Cipla, Glenmark Pharmaceuticals, Lupin, Divi's Laboratories and Aurobindo Pharmaceuticals. The index improved by 9.3 per cent during 2015.

The benchmark BSE Sensex index of leading 30 companies was under pressure and closed lower at 26,117.54, de-growth of 5 per cent during the year 2015. It closed at 26,117.54 points on the last trading day of 2015 as against 27,499.42 points on December 31, 2014. On the first day of trading on January 1, 2015 the index was at 27,507.54 points. BSE Sensex touched to its yearly high level at 30,024.74 on March 4, 2015. However, due selling pressure the index touched to its yearly lowest level at 24,833.54 on September 8, 2015.

The pharmaceutical segment received mixed response from investors and relatively small companies ended with hefty jump in share prices. Among the BSE Healthcare index, Bliss GVS Pharma, Caplin Point Laboratories, Dishman Pharmaceutical, Jubilant Life Sciences, Morepen Laboratories, RPG Lifesciences and Sequent Scientific scrip improved over 100 per cent during 2015. Similarly, Abbott India, Alembic Pharmaceutical, Fortis Healthcare, Marksans Pharma, Necter Life Sciences, Neuland Laboratories, Sun Pharma Advance Research Company (SPARC) Vimta Laboratories and Wockhardt registered strong growth of over 50 per cent during 2015.

The shares of Sun Pharmaceuticals, Dr Reddy's Laboratories, Aarti Drugs, Aurobindo Pharma, Divi's Laboratories, Merck, Opto Circuit, Orchid Chemicals, Panacea Biotec, Sharon Bio-Medicine, Venus Remedies and Syncom Formulations received setback during 2015. The leading two companies viz., Sun Pharmaceutical and Dr Reddy's Laboratories suffered due to US FDA warning letter and quality problems. Ajanta Pharma, Cadila Healthcare, Granules India, Hikal, Natco Pharma, Poly Medcare, Shilpa Medcare and SMS Pharmaceutical split their face value of equity share during 2015. At the fag end of 2015, Cadila Healthcare received warning letter from US FDA for its Ahmedbad and Moraiya facilities and scrip declined sharply to Rs. 328.70 on BSE.

Few important factors like US FDA warning letters regarding quality for major companies, stiff competition, new drug price control order, slower products approval rate from regulated authorities, returns from R&D investments and adverse exchange rate fluctuations impacted the bottomline of several companies, which in turn dampen the sentiment of investors. However, consolidation and spreading of activities in new markets as well as merger & acquisitions offer some assistance to boost investors confidence in pharma segment. Relatively, small and medium pharma companies performed well and offer better returns to investors in the form of dividend, stock splits and price movements.

Three new companies viz., Syngene International, Alkem Laboratories and Dr Lal Path Lab entered capital market with initial public offer and received strong investors support. Syngene issued 81.20 lakh shares of Rs. 10 each with a price band of Rs. 240-250 in July 2015. On December 8, 2015, Alkem entered capital market with issue size of 90.87 lakh shares with a price band of Rs. 1,020-1,050 and Dr Lalpath Lab with an issue size of 81.20 lakh equity shares of Rs. 10 each with price band of Rs. 540-550. All the issues were oversubscribed significantly. Currently, Alkem is moving around Rs. 1,475 and touched to its peak level at Rs. 1,544. Dr Lal Path Lab touched to its highest level at Rs. 908.10 on December 28, 2015 and currently moving around Rs. 820 on BSE. Syngen also moved to highest level at Rs. 412.70 on December 29, 2015.

Based on first half ended September 2015 financial performance, the outlook for the Indian pharmaceutical sector for the year ending March 2016 will be extremely bleak. Based on the financial performance of Pharmabiz sample of leading 50 Indian pharmaceutical companies for the first half ended September 2015, the top line and bottom line growth will be only single digit for 2015-16. The quality problems may put additional burden on top line during 2015-16.

|