Sales Force Effectiveness or SFE is gaining new ground this year as pharma companies strive to improve productivity and hence efficiency of the sales team. In the Indian pharma industry, we see a lot of new steps that pharma companies may take to find ways of trying to improve efficiency through SFE solutions. This article highlights from our perspective on what to watch out for in the year 2016.

Closed loop marketing

There is renewed interest among pharmaceutical companies in understanding customers (doctors) and this will continue to be the focus for this year with even greater emphasis. A lot of Indian pharma companies are expected to go down this lane by using e-detailing as the medium to give interesting and interactive content to the doctors and use that to understand doctor’s interests and feedback.

Let us go back to basics and understand what closed loop marketing is all about.

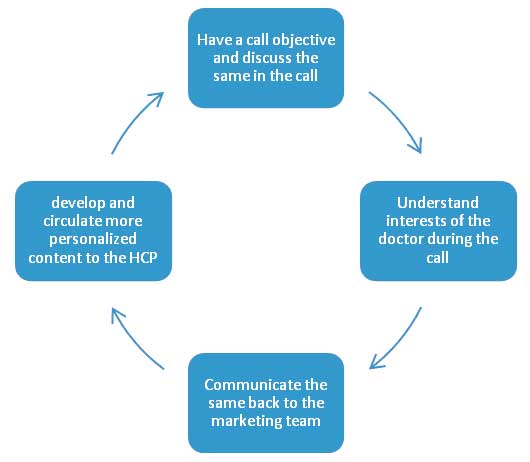

Closed loop marketing is a way of redefining customer interaction between a sales person and the health care professional (HCP). Through this interaction the sales person tries to gain insights on the interests of the doctor which is then fed back to marketing and brand management teams who help him/her define more personalized content and information for that HCP to subsequently to improve customer interaction. This process over time improves both sales and marketing effectiveness.

Figure 1: CLM in pharma

Though we to achieve full closed loop marketing, the pharma companies still need some level of maturity in the current processes - companies are still keen to implement e-detailing as a starting point to get doctor’s interest and eventually upgrade to complex analytics to analyse all the data points captured through e-detailing to achieve more effective closed loop marketing.

Though we to achieve full closed loop marketing, the pharma companies still need some level of maturity in the current processes - companies are still keen to implement e-detailing as a starting point to get doctor’s interest and eventually upgrade to complex analytics to analyse all the data points captured through e-detailing to achieve more effective closed loop marketing.

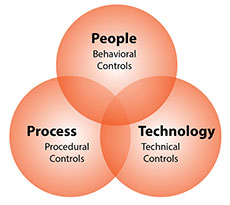

Companies can remember the following 3 key things to achieve CLM

Empower first line sales manager

Pharma companies are starting to realize that with all the automation that they do still focuses on medical reps efforts and how a manager can bring in the required efficiency in his team has been not been the focal point. We see this changing now and believe that 2016 will see manager empowerment – in turn enabling the medical reps to do better. Some of the points that companies expect from the SFE solutions are:

1. Sales target v/s achievement percentage that can be drilled down to Medical rep level so that the manager knows how each of his medical rep is performing. Analyzing how close or how far the team is from their target may also enable the manager to drill down and allocate the remainder percentage of achievement among his team judiciously.

2. Call efforts by the medical rep are worth analyzing – call average, call frequency, call plan v/s his actual – this will give an idea on where the medical reps time is going. These can be short term analysis that can be viewed on a weekly basis, to enable the manager to correct anything that the medical rep is lacking on.

3. Actions taken to help the medical reps have to be recorded for followup, and ensuring execution.

4. A good solution will guide the FLSM in allocating the right time in joint work, to the right medical reps, and also help in providing the most appropriate coaching and training inputs.

Effort v/s Results

Most of the sales force effectiveness applications focus on capturing all effort related parameters from all angles. What is missing is correlation between these efforts to the results that the sales team gets. For any pharma company three results parameters important to be measured are:

1. Primary sales

2. Secondary sales and

3. Doctor prescriptions

Primary sales

Primary sales is normally captured in the ERP solution. Some of the companies set targets on the basis of primary data, hence mapping this data onto a CRM platform will help the medical rep track where he/she is in terms of sales achievement.

Secondary sales

Similarly, secondary sales, either obtained at source from stockists or captured by medical reps in an application has to be processed and mapped, in order to disseminate the data to the field. This is usually the true value of sales and hence holds more importance to the pharma company than primary sales.

Doctor prescription data

In India, this data enables the company to track the prescription of its brands versus its competitor brands at any given point of time.

All the three parameters when associated with effort parameters give the true measure of the sales team. This interlinking and co comparison will become very important going forward as face time with doctors is on a significant decline and companies want to achieve more sales with less effort.

Social media integration

With more and more customers opting for social media as a channel to make conversation, it becomes very important for firms to tap into social channels as a way to reach out to their customers. Integrating these platforms into SFE gives companies supreme competitive advantage providing them control over perception creation about the brand and customer service. This can have the following advantages:

- Mitigation of adverse effects from negative customer feedback by being more proactive in responses

- Easy monitoring of social trends and customer behaviour

- Effective reach out to opinion leaders

- Constant feedback from customers, hence easy to progressively shift to value delivery processes

Though the lines on compliance and regulatory are not too clearly defined yet for social media usage – more and more pharmaceutical companies are looking forward to experiment, listen to their customers and react to their needs through this platform integration.

ConclusionWith the continuously evolving and dynamic environment it is important that technology partners also keep up with the pace of the industry and offer complete solutions to address challenges that the pharma and medical device industry may be facing. This will help in streamlining all the sales and marketing processes at any given point of time and provide useful inputs to the top management for decision making.

(Authors are expert in marketing)