Ajanta Pharma gearing up to tap big opportunities in key segments, scrip touches Rs.1800

Ajanta Pharma a Rs.1,200 crore specialty formulations pharma major from Mumbai, is all set to grab future opportunities with investment in expansion, research & development and new markets. After registering all-round performance during 2013-14, the company posted healthy growth in top line and bottom line during the first quarter ended June 2014. Its earnings per share for the year 2013-14 went up sharply to Rs.66.54 from Rs.31.91, a significant growth of 109 per cent. The company management is taking due care of shareholders and declared handsome equity dividend of 200 per cent and bonus shares in the ratio of 1:2.

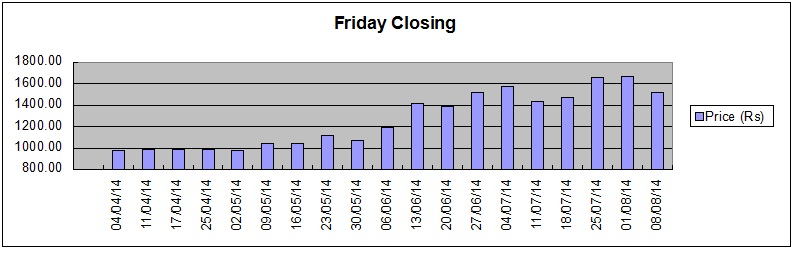

Consistent growth in top line and bottom line during last couple of years, Ajanta Pharma gained investors confidence and the Rs.5 per share moved up almost four times within one year and recently touched to its yearly highest level at Rs.1,798 on Bombay Stock Exchange. The scrip was moving around its lowest level at Rs.475 in August 2013. Its market capitalisation reached at Rs.5600 crore. Currently, promoters are holding strong stake of 73.6 per cent in the equity capital followed by individual shareholders of 14.2 per cent and foreign financial institutions 7.9 per cent.

For the full year ended March 2014, Ajanta's consolidated net sales crossed Rs.1000 crore mark for the first time and touched to Rs.1,208 crore from Rs.931 crore in the previous year, a significant growth of almost 30 per cent. Earnings before depreciation, interest, taxation and adjustments (EBDITA) improved smartly by over 66 per cent to Rs.382 crore from Rs.230 crore and its net profit went up by 109 per cent to Rs.234 crore from Rs.112 crore.

As against the equity capital of Rs.17.67 crore its reserves & surplus stood at Rs.576 crore as against Rs.382 crore, a growth of 51 per cent. The company has reduced its long term borrowings to Rs.52 crore from Rs.73 crore. Its fixed assets improved to Rs.279 crore from Rs.273 crore and capital work-in-progress amounted to Rs.94 crore as against Rs.12 crore. It invested Rs.55 crore in mutual funds as against nil in the previous year.

Ajanta is focusing on branded generics in domestic and emerging markets and its 80 per cent of revenue is coming from branded generics. The company has established its strong presence in three major therapeutic area viz., dermatology, cardiology and ophthalmology and now building its presence in the pain management segment.

Ajanta has built up over 48 brands in dermatology, 27 brands in cardiology and 54 brands in ophthalmology. In pain management it has developed over 32 brands. The company has presence in over 30 countries with basket of over 200 products.

The company is focusing on R&D activities with higher investment. Its aggregate R&D expenditure during last five years touched to Rs.214 crore accounting for about 6 per cent of its revenues. At present 350 research professionals are engaged in the R&D activities. The company launched 119 first-time products in India during last decade. The company received approval for two ANDAs viz., risperidone and levetiracetam from US FDA. Its 21 ANDAs are pending approvals in US and the company management expects more and more approvals from US FDA in next three years. Its R&D revenue expenditure increased to Rs.50 crore from Rs.37 crore in 2012-13. The company has invested in five overseas subsidiaries and set up one joint venture.

After the announcement of financial performance for the first quarter ended June 2014, Ajanta Pharma scrip declined and now moving around Rs.1,520 as its net sales and net profit dropped as compared to previous quarter ended March 2014. Its net sales declined to Rs.281 crore during the June quarter from Rs.301 crore in March 2014 quarter and its net profit went down to Rs.59 crore from Rs.70 crore in the similar period. This impacted the scrip price movements.

However, it has posted strong growth in net profit of 80.5 per cent to Rs.58.72 crore during the first quarter ended June 2014 from Rs.32.54 crore in the corresponding period of last year. Its net also moved up by 30.4 per cent to Rs 280.79 crore from Rs.215.39 crore. With hefty jump in profits, its EPS improved to Rs.16.70 from Rs.9.26. Ajanta's sales in emerging market improved by 34 per cent to Rs.160 crore. Its sales in Africa improved by 42 per cent to Rs.92 crore, Asia by 26 per cent to Rs.65 crore and that in Latin America improved by 8 per cent to Rs.3 crore. It launched 14 new products in the emerging markets and has a pipeline of about 1,600 products under registration to ensure continued growth. Thus, the financial performance as compared to previous year quarter is very strong and the company will consolidate its position in competitive environment.

Ajanta Pharma : Highlights