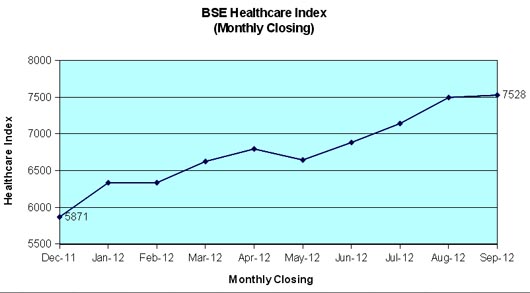

BSE Healthcare index outperform BSE Sensex in first nine months of 2012

The BSE Healthcare (BSEHC) index has outperformed BSE Sensex during the first nine months of the year 2012 and moved up by 28.2 per cent as compared to 21.4 per cent growth registered by BSE Sensex of 30 companies. The important factors like improved European economic outlook, announcement of economic reforms by Central Government, improved rainfall and reduction in CRR by RBI assisted price movements. The pharmaceutical segment received strong investors support and several scrip touched to new high during September 2012 on account of strong financial performance during June quarter and product approvals.

BSEHC of leading 17 companies reached at its 52-weeks peak level at 7794.11 points on September 12, 2012. However, it closed at 7528.41 points at the end of last trading day of September and the full market capitalization of these scrip worked out to Rs.295,724 crore. BSE Sensex touched to its 52-weeks peak level at 18869.94 on the last trading day of September as against its yearly low level of 15135.86 on December 20, 2011. The Sensex of 30 companies moved up session after session and crossed 18,000 mark on September 12 for the first time after February 23, 2012.

The major scrips from BSEHC like Apollo Hospitals, Aurobindo Pharma, Cadila Healthcare, IPCA Laboratories, Lupin, Ranbaxy Laboratories, Strides Arcolab, Sun Pharmaceutical and Worckhardt touched to new yearly high during September 2012. Further, other leading companies like Cipla, Jubilant Lifesciences and Torrent Pharma also moved significantly during September 2012 and reached at their highest level during September 2012.

Despite worldwide economic slowdown, uncertainty in Eurozone debt crisis, stiff competition and cost cutting measures adopted by several highly regulated nations, the leading 100 Indian pharmaceutical companies, including 11 multinationals, registered strong operational performance during the quarter ended June 2012. Higher investments in R&D, improved product filings, approvals and sales exclusivity helped to boost operational performance. The EBDITA (earnings before depreciation, interest, taxation and adjustments) of Pharmabiz sample of 100 companies increased by 30.1 per cent to Rs.7,674 crore during the quarter ended June 2012 from Rs.5,898 crore in the corresponding period of last year. Out of 100 companies 61 players registered growth in EBDITA. The improvement in operational performance assisted well for investors confidence during last couple of months.

During the last couple of months Indian pharma companies received several important approvals from highly regulated bodies which also helped the uptrend in scrip price movements. Indian companies, through their foreign subsidiaries, are spreading their marketing efforts and launching new products.

Ranbaxy Malaysia Sdn Bhd, a wholly owned subsidiary of Ranbaxy Laboratories Ltd has received approval from the Government of Malaysia for setting up a Greenfield manufacturing facility in Malaysia as an EPP (Entry Point Project). This will be Ranbaxy’s second manufacturing facility in Malaysia. The announcement was made by Dato' Sri Mohd Najib bin Tun Abdul Razak, the Prime Minister of Malaysia, at a ceremony held in Putrajaya, Malaysia. Ranbaxy will be investing around RM 125 million (US$ 40 million) in this project that will provide employment to over 200 people. Ranbaxy scrip touched to its 52-week peak level at Rs.578.30 on September 4, 2012 and currently moving in the range of 520-130 on BSE.

Apollo Hospital scrip went up to its highest level at Rs.750 on the last trading day of September 2012. The Apollo Hospitals Group has signed a memorandum of understanding (MoU) with Africa-based AfroIndia Medical Services to set up 30 telemedicine units in East and West Africa. These telemedicine centres will facilitate the doctors in several African countries to interact with specialist at Apollo.

Strides Arcolab scrip moved to its peak level at Rs.958 on September 10, 2012 as received the US FDA approval for its ‘Polish Sterile facility’.This state-of-the-art facility located in Warsaw, Poland, manufactures vials, ampoules, pre-filled syringes and lyophilized injections. With this approval all eight global sterile injectable sites of Agila are now approved by the US FDA and EU authorities and places Agila amongst the largest global capacities for sterile injectables.

In a landmark judgment, the Delhi High Court on September 7 dismissed Swiss drug major Hoffmann-La Roche's patent case against India's generic drug major Cipla Ltd for its lung cancer drug Tarceva. Cipla scrip went up smartly and grabbed new yearly high at Rs.395.45 on September 10, 2012.

After a four-year hearing, the court dismissed Roche's suit accusing Cipla of infringing the Swiss company's patent for its lung cancer drug. The judgement will allow Cipla to continue selling its generic version of the drug Erlocip, besides paving the way for entry of similar low-cost versions.

Dr Reddy's Laboratories, a second largest Indian pharma company with consolidated net sales of Rs.9,675 crore, has received manufacturing contract from Beverly, Massachusetts-based clinical stage biopharmaceutical company, Cellceutix Corporation for a new drug candidate Prurisol, for the treatment of psoriasis. Celleceutix is a a clinical stage biopharmaceutical company focused on discovering small molecule drugs for hard to treat diseases. DRL recently launched amoxicillin tablets, capsules and oral suspension, a bioequivalent generic version of Amoxil (amoxicillin) tablets, capsules and oral suspension in the US market.

Wockhardt has received final approval from the US FDA for marketing 15 mg and 30 mg delayed release capsules of lansoprazole, which is used in treatment of peptic ulcers. Lansoprazole is the generic name for the brand Prevacid, marketed in the US by Takeda. Wockhardt is launching the product immediately. Wockhard has strengthen its bottomline and overcome its financial problems during last few quarters and the scrip is moving around Rs.1300 on BSE with 52-weeks high of Rs.1437.

Thus, the Indian companies are well set to spread their business operations in highly regulated market as well as emerging markets in the coming years through launching new cost effective products. The Indian pharma companies have recommended satisfactory returns in the form of dividend to their investors during 2011-12 on account of better performance. These factors will offer necessary support for share price movements in the near future.