Pharma scrips close 2014 on promising note, BSEHC moves up by over 47% in 2014

The Indian pharmaceutical companies have closed the year 2014 on promising note and registered significant growth in market capitalization. With better financial performance despite competition, new drug price control order, quality problems and lower approvals from highly regulated markets, the pharma scrips enjoyed strong investors confidence as well as support from financial institutions during 2014. Investors clocked up higher returns in the form of equity dividend and share price movements. Several pharma companies restructured there business and divested there part of operations. Further, the Sun Pharma - Ranbaxy deal changed the dynamics of the market.

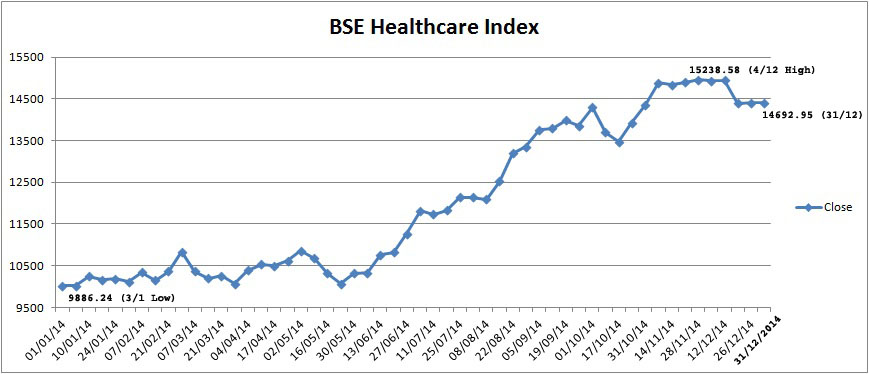

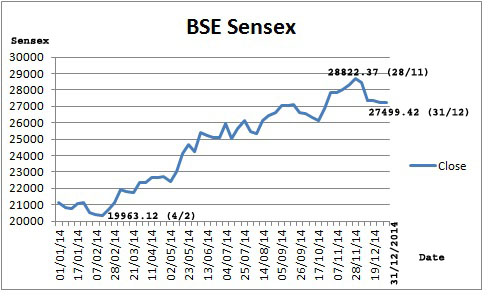

The BSE Healthcare (BSEHC) index of 17 pharma companies moved up by 47.4 per cent to 14692.95 points as at the close of year 2014 from 9966.26 points on December 31, 2013. The BSE Sensex of 30 major companies, from various sectors of Indian economy, moved up only by 29.9 per cent to 27499.42 points from 21170.68 points on December 31, 2013. Thus, the Healthcare index outperformed BSE Sensex during 2014. The new central government assisted well to improve investors sentiment.

The BSEHC index touched to its yearly peak level at 15238.58 on December 4, 2014 as against its yearly lowest level of 9886.24 on January 3, 2014. The BSEHC moved up smartly and crossed 11,000 mark on June 18 2014 and 12,000 mark on July 7, 2014. The index achieve another milestone of 15,000 mark on November 10 and reached at its yearly peak level at 15238.58 on December 4. The BSE Sensex index reached at yearly highest level at 28822.37 on November 28, 2014 and lowest at 19,963.12 on February 4, 2014.

The major scrips from BSEHC like Aurobindo Pharma, Torrent Pharma and Wockhardt improved by over 125 per cent during 2014 to Rs. 1136.40, Rs. 1131.30 and Rs. 1009.75 respectively. Similarly, Cadila Healthcare, Cipla, Lupin, went up by over 50 per cent during 2014 to Rs. 1598.35, Rs. 625.80 and Rs. 1427.55.

With stringent approval norms by US FDA, the Indian pharma companies secured 102 ANDAs approvals upto December 19, 2014 as against 154 ANDAs in the previous year. Similarly, tentative approvals were at 33 as against 38 in the 2013. The US FDA approved total 336 ANDAs upto December 19, 2014 as against 400 in the 2013 and 476 in the year 2012.

The pharmaceutical companies are focusing on research and development (R&D) and increasing there investment in R&D to enter new geographies. The Indian companies are building up strong product pipeline. The R&D expenditure of 25 leading Indian pharma companies increased by 20.6 per cent to Rs. 6,103 crore during 2013-14 from Rs. 5,060 crore in the 2012-13 and Rs. 4,178 in 2011-12. R&D expenditure as percentage of standalone net sales worked out to over 7 per cent for last three years. Though this investment is small as compared to investment made by major international players, these companies set to capture upcoming opportunities with expiration of patents. Several companies are set to launch new generics in highly regulated markets with exclusivity period in the coming years.

The US FDA has taken stringent action against leading Indian companies like Ranbaxy, Wockhardt and others during 2014 and stopped exporting drugs from these companies on account of quality problems and compliance related issues. The frequent audits by US FDA on the Indian plants of both multinationals and Indian companies have led to an increased number of issuance of warning letters.

Based on the financial performance during first half year ended September 2014, the Indian pharmaceutical companies are set to achieve net sales growth of 15 per cent in 2014-15 and similar growth in profits. Thus the returns on investment will remain positive and investors may get handsome returns.

companies, from various sectors of Indian economy, moved up only by 29.9 per cent to 27499.42 points from 21170.68 points on December 31, 2013. Thus, the Healthcare index outperformed BSE Sensex during 2014. The new central government assisted well to improve investors sentiment.

The BSEHC index touched to its yearly peak level at 15238.58 on December 4, 2014 as against its yearly lowest level of 9886.24 on January 3, 2014. The BSEHC moved up smartly and crossed 11,000 mark on June 18 2014 and 12,000 mark on July 7, 2014. The index achieve another milestone of 15,000 mark on November 10 and reached at its yearly peak level at 15238.58 on December 4. The BSE Sensex index reached at yearly highest level at 28822.37 on November 28, 2014 and lowest at 19,963.12 on February 4, 2014.

The major scrips from BSEHC like Aurobindo Pharma, Torrent Pharma and Wockhardt improved by over 125 per cent during 2014 to Rs. 1136.40, Rs. 1131.30 and Rs. 1009.75 respectively. Similarly, Cadila Healthcare, Cipla, Lupin, went up by over 50 per cent during 2014 to Rs. 1598.35, Rs. 625.80 and Rs. 1427.55.

With stringent approval norms by US FDA, the Indian pharma companies secured 102 ANDAs approvals upto December 19, 2014 as against 154 ANDAs in the previous year. Similarly, tentative approvals were at 33 as against 38 in the 2013. The US FDA approved total 336 ANDAs upto December 19, 2014 as against 400 in the 2013 and 476 in the year 2012.

The pharmaceutical companies are focusing on research and development (R&D) and increasing there investment in R&D to enter new geographies. The Indian companies are building up strong product pipeline. The R&D expenditure of 25 leading Indian pharma companies increased by 20.6 per cent to Rs. 6,103 crore during 2013-14 from Rs. 5,060 crore in the 2012-13 and Rs. 4,178 in 2011-12. R&D expenditure as percentage of standalone net sales worked out to over 7 per cent for last three years. Though this investment is small as compared to investment made by major international players, these companies set to capture upcoming opportunities with expiration of patents. Several companies are set to launch new generics in highly regulated markets with exclusivity period in the coming years.

The US FDA has taken stringent action against leading Indian companies like Ranbaxy, Wockhardt and others during 2014 and stopped exporting drugs from these companies on account of quality problems and compliance related issues. The frequent audits by US FDA on the Indian plants of both multinationals and Indian companies have led to an increased number of issuance of warning letters.

Based on the financial performance during first half year ended September 2014, the Indian pharmaceutical companies are set to achieve net sales growth of 15 per cent in 2014-15 and similar growth in profits. Thus the returns on investment will remain positive and investors may get handsome returns.