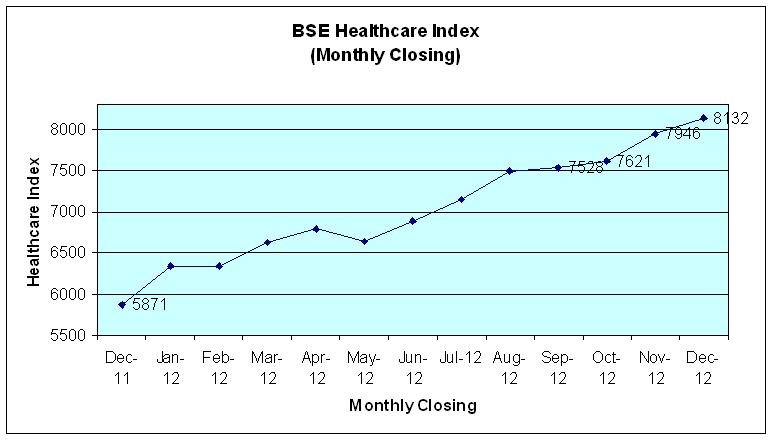

The Bombay Stock Exchange Healthcare (BSEHC) index of 17 leading pharmaceutical companies outperformed Bombay Stock Exchange Sensitive Index (Sensex) of 30 companies during year 2012 on account of strong fundamentals, higher approvals, product launches, enhance presence in regulated markets and investments in R&D. With few positive changes like compulsory licensing, new drug price control policy and loss of few patent exclusivity, the BSEHC index closed at 8132.35 points on the last trading day of 2012 with significant gain of 38.5 per cent during 2012. The Sensex closed at 19426.71 points on December 31, 2012 with a yearly gain of 25.7 per cent.

The BSEHC index reached at its yearly peak level at 8285.71 points as on December 20, 2012 as against yearly low level at 5835.48 points as at the beginning of the year 2012. The Sensex registered its peak level at 19612.18 points on December 11, 2012 as compared to its lowest level at 15358.02 on January 2, 2012. The downward trend experienced in share prices during 2011 was marked by uncertainty regarding European debt crisis, weak domestic economic indicators, a lack of momentum on policy reforms, interest burden, redemption of FCCBs, rising deficit, rupee depreciation and subdued FIIs approach.

There are 168 pharma companies listed on BSE as at the end of 2012, of which 15 companies are in A Group, 103 in B Group, 48 in T Group and two in Z group. Out of 15 A Group pharma companies, 13 were included in BSEHC and four scrips from B Group.

Wockhardt scrip was the star performer of 2012 with impressive yearly gain of over 471 per cent. The scrip closed at Rs.276.05 as at the end of December 2011 and climbed up to Rs.1577 as at the end of December 2011. Similarly, few scrips like Aarti Drugs, Aurobindo Pharma, Dishman Pharmaceuticals, Shasun Pharma, and Strides Arcolab registered strong growth in share price of over 100 per cent during 2012. Further, Aanjaneya Lifecare, Claris Lifesciences, Fulford India, Glenmark Pharma, Ipca Laboratories, Natco Pharma, Panacea Biotec and Unichem Laboratories scrips went up by over 50 per cent in 2012. Indoco Remedies changed its face value of share from Rs.10 per share to Rs.2 per share.

Few major pharma companies shares like Ankur Drugs, Ind-Swift Laboratories, Ind-Swift Ltd, Orchid Chemicals & Pharmaceuticals, Parabolic Drugs, Parenteral Drugs, Plethico Pharmaceutical, Surya Pharmaceutical and Twilight Litaka Pharma received setback and their share price dwindled during 2012. Sanofi India's (formerly known as Aventis Pharma) shares remained almost unchanged at Rs.2,299.

The world economy started showing some improvement in the early part of 2012 and continue to show some positive trends till the end of the year 2012. The results of US President elections and improved economic outlook in Grease, Spain and other European countries with helping hand from other countries gave some sort of relief to investors community worldwide.

The Indian capital market maintained upward trend from the beginning of the year 2012 despite overall sluggish worldwide economic indicators and domestic political crisis. The better financial performance by pharmaceutical companies with higher approvals from regulatory authorities, new product launches in US, Europe and emerging markets and higher exports assisted well to improve investors sentiment. Indian pharmaceutical companies also infuse more funds on research and development activities. Further, loss of patent exclusivity for blockbuster pushed the top line growth of several Indian companies. All most all pharma scrips registered satisfactory upward price movement during 2012.

For the first half ended September 2012, leading 40 pharma companies (with year ending in March 2012) achieved strong growth in top line as well as bottom line. The net sales of 40 companies increased by 25.8 per cent to Rs.50,060 crore as against Rs.39,795 crore in the corresponding half of last year. There EBDITA also moved up by 27.2 per cent to Rs.12,773 crore from Rs.10,045 crore. The net profit also moved up by 25.8 per cent to Rs.6,807 crore from Rs.5,412 crore. Sun Pharmaceuticals, Dr Reddy's Laboratories, Lupin, Cipla Cadila Healthcare, Wockhardt, Aurobindo Pharma, Jubilant Life Sciences, Priamal Healthcare, Parabolic Drugs, Unichem Laboratories, etc. notched strong growth in sales and profits.

Few companies like Ranbaxy Laboratories, GlaxoSmithKline Pharmaceuticals, Sanofi India (formerly known as Aventis Pharma), Strides Arcolab, Abbott India, Merck and Plethico Pharma announced financial performance for the first nine months ended September 2012. There aggregate net sales increased by 26 per cent to Rs.16,908 crore from Rs.13,416 crore in the corresponding nine months of last year. The EBDITA also improved by 46.2 per cent to Rs.3,943 crore from Rs.2,697 crore mainly due to significant growth in EBDITA of Ranbaxy.

The foreign exchange rate between Indian rupee and US Dollar remained volatile during 2012 with uncertainty. The exchange rate touched to its yearly high level at Rs.56.47 for a dollar as against the lowest level at Rs.49.28. This put pressure on import cost during 2012 as well as foreign currency loans.

The investments in R&D is yielding better results for the Indian pharmaceutical companies and their subsidiaries with higher approvals for ANDAs despite existing stringent approvals norms of US FDA. Indian companies managed to get 88 ANDA approvals from US FDA during the first half ended June 2012 which worked out to 41.1 per cent of the total approvals of 214 ANDAs. During first half of 2011, US FDA approved a total 238 ANDAs, out of which Indian companies received 88 final approvals.

Indian pharma companies filed 269 DMFs in US during the first nine months ended September 2012. The major companies like Hetero Drugs, Emcure Pharmaceuticals, Aurobindo Pharma, Dr Reddy's Laboratories, Lupin, Macleods Pharmaceuticals filed more than eight DMFs. Further, Hetero Labs, Unimark Remedies, Neuland Laboratories, MSN Laboratories, Alembic Pharmaceuticals, Apotex Pharmachem India Pvt Ltd and CTX Life Sciences Pvt Ltd filed five to seven DMFs during the first nine months of 2012. The total DMFs filed by the Indian companies stood at 404, 311 and 271 during the year 2011, 2010 and 2009 respectively. This shows that the investments in R&D and facilities started yielding results and Indian companies have able to file higher numbers of DMFs.

The Controller General of Patents granted India’s first compulsory license to Natco for Bayer’s kidney-cancer drug Nexavar in March 2012. This allowed Natco to sell a low-cost version at three per cent of the original medicine’s price on the grounds that the Rs.2.8 lakh (US$ 5,600 ) charged by Bayer for a month’s dosage was too high for patients in India. This change in policy will assist well for growth of domestic players in the near future.

The Central government issued the National Pharmaceuticals Pricing Policy, 2012 (NPPP-2012) to put in place a regulatory framework for pricing of drugs so as to ensure availability of required medicines – “essential medicines” – at reasonable prices. The Government brought 348 essential drugs under price control. Similarly, it allowed 100 per cent FDI in greenfield projects and over 49 per cent in existing projects with certain permissions.

The overall share price of listed 11 MNCs viz., Abbott India, AstraZeneca Pharmaceuticals, Fresenius Kabi Pharma, GlaxoSmithKline Pharma, Merck, Novartis India, Pfizer, Ranbaxy Laboratories, Sanofi India, and Wyeth remained subdued during the year 2012 mainly due to the government's compulsory licensing and price control policy. The Indian companies shares received strong support from investors as compared to MNCs. Only Ranbaxy Laboratories, Fulford India and Fresenius Kabi scrips moved up by over 20 per cent.

Thus, the overall outlook for the Indian pharma segment is positive compared to other segments of the economy. The Pharma companies are likely to offer better returns in the form of dividend with satisfactory growth in profitability in the range of 18-20 per cent. The pharma segment will able to garner investors confidence with investment in R&D and focus on regulated markets and loss of patent exclusivity in the current year.

Share price as at the end of 2012 & 2011